Medium-Term Business Plan

FY2025.3 ▶ FY2027.3

*The information is as of May, 2024 (during the fiscal year ending March 2025).

Slogan and the Positioning of the Plan

Connecting Growth-Origin/Next 50

Based on our "Starting Point," "Strengths," and "Vision for the Future," we will develop niche, unique, and edgy businesses in the spirit of the Group, with an eye toward change over the next 10 years.

Business Environment Outlook

Automotive industry

Automotive industry

A once-in-a-century period of industry transformation.

Widespread adoption of connected cars and automated driving.

Changes in vehicle usage, such as CASE and MaaS.

Real estate industry

Real estate industry

Rising real estate prices and polarization.

Delay in IT/DX in an industry.

Lack of condominium management staff.

Warranty-related industry

Warranty-related industry

Due to an aging population and the shift to nuclear families, rent guarantees are increasingly in demand.

Continued expansion of product warranties, extended warranties, etc. due to growing interest in SDGs and awareness of using products for a long time.

Call center industry

Call center industry

Increased demand due to labor shortages across all industries.

Recruitment difficulties, rising labor costs.

AI diffusion.

Management Targets by FY2027.3

Strategy Overview

1. Creating growth potential

Thoroughly improve the quality and profitability of existing businesses.

【Company Actions】

Creating growth potential by improving quality and profitability

-

Revenue management for each BPO center/project

-

Selection and concentration of existing consigned projects and reasonable pricing

-

Common infrastructure for operation systems

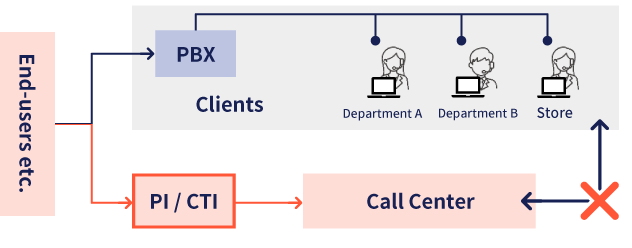

2. Development of service platform-based revenue model

Develop a pay-per-use business model that does not rely on human capital.

Current example Charged per ID

【Challenges】No collaboration / No real-time sharing of data / Higher operating costs

【Advantages】

- Reduced initial installation costs: Existing company phones can be used, and there is no need to overhaul the Internet environment, reducing costs.

- Coexistence with existing external and internal company phones.

- Real-time data sharing.

- Unify multiple communication methods such as mobile phones and wireless used in the store.

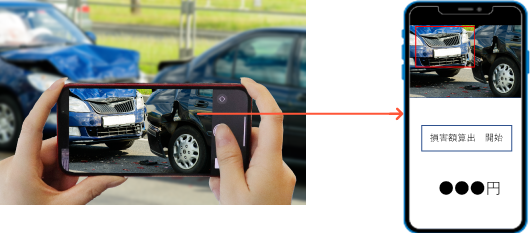

Future pay-per-use business model

(example) Charged per case

Automatically calculates the amount of damage, using AI with captured images of vehicle damage when dispatching roadside assistance.

3. Flexible expansion of the sites

Meet growing demand by opening satellite BPO centers (Approx. 100-150 seats).

- Establish satellites to connect large BPO sites and promote employment by expanding the area as a whole rather than just a single point.

- Targeting areas where commuting is long and recruiting is difficult, and where female participation in the workforce is high.

- Rapidly expand contract capacity

Business Strategy

Strategies by segment Automotive Business

Automotive Business

Existing projects

- Reasonable Price

- Expand existing demand

- Manpower savings

- Selection & Concentration

Opportunity to capture new demand

- Three Strengths That Provide a Service TrinityProvide each service with functions that meet clients’ needs

Strategies by segment Property Business

Property Business

- Expansion of the targets of the service from the 53.7 million housing units.

- Future generation services that combine patrol management and technologySmart Desk・Smart Call (Smart Management)

①Providing a solution to the caretaker shortage

①Providing a solution to the caretaker shortage

by offering unmanned condominium management.

Housing equipment on-site support

②Package includes unattended janitorial services.

②Package includes unattended janitorial services.

③Provide services such as general reception and on-site support, etc. through alliances with multiple companies.

③Provide services such as general reception and on-site support, etc. through alliances with multiple companies.

Support for

exclusive-use areas and common areas

Point

These will be provided to condominium developers and management companies

as a future generation management service.

Strategies by segment Global Business

Global Business

Increasing the number of touch points in the expatriate & international traveler market within the cycle from before departure to return home.

- Create an economic zone for the Global Business.Aiming for new value creation

During travel/stay

Main services during travel/stay

Before departure and temporarily returning

In collaboration with HCP, promote the brand even before members move to the country to which they have been assigned.

Create opportunities for collaboration with local solution services such as JHD, HCP, and MSP, and establish an economic zone for PI's healthcare-related business across domestic and international borders.

Point

Provide services as a foot in the door to address inbound needs, one of the few growth markets in Japan in the future.

JHD

Japanese Help Desk

|

Set up a help desk for Japanese patients in the hospital to assist them in every step of the process related to their medical treatment

*Commissions will be paid for each case of support. |

53 locations in Southeast Asia

*As of the end of March 2024 |

PHC

Premier Health Clinic

|

The clinic specializes in medical care for Japanese people, including transparency in reimbursement and explanation of medical treatments and medicines in Japanese. |

2 clinics in India

1 clinic in Mexico

*As of the end of March 2024 |

Strategies by segment Financial Guarantee

Financial Guarantee

Further expand and strengthen property rent guarantees as a pillar of growth and profit, and develop medical care and eldercare expense guarantees toward the growth stage.

- Developing in Vietnam, Myanmar and Thailand, with Singapore serving as the hub.

- Promote the commonality, labor savings, and automation of the service platforms.

|

FY2024.3 |

FY2025.3 |

FY2027.3 |

| Domestic |

100 staff |

100 staff |

100 staff |

Overseas

|

100 staff |

200 staff |

300 staff |

Total

|

200 staff |

300 staff |

400 staff |

Point

- Voice and natural language dialogue services → Differential incoming calls and optimization

- Applying image understanding technology → Accident assessment

- Support for intellectual work → Information entry and registration, Improve back-office operations

Shareholder Return Policy

- Increase the dividend payout ratio from the current level of approx. 30% to approx. 60% or more by the fiscal year ending March 2026.

- Aiming for a total return ratio of at least 70%, a total of 13 billion yen will be returned to shareholders by the fiscal year 2027, the final year of the plan, including share repurchases (up to 3 billion yen), taking into account the share price situation.

- Improve ROE and dividend yield to make the company an attractive to investment.

- Dividend payout ratio60% or more by FY 2026.3

- Total return ratio70% or more by FY 2027.3

Environment Initiatives

(unit: t-CO2)

| Data |

FY2021.3 |

FY2024.3 |

Year of 2050

(FY2051.3) |

| Scope1 |

Gasoline and diesel fuel-based

|

3,101 |

4,133 |

0 |

| LPG, LNG, City gas based |

1,366 |

887 |

0 |

Total of Scope 1

|

4,467 |

5,019 |

0 |

| Scope2 |

3,375 |

1,673 |

0 |

| Total of Scope 1 and Scope 2 |

7,842 |

6,692 |

0 |

| Reduction Amount vs. FY2021.3 |

ー |

△1,150 |

7,842 |

| Reduction Ratio vs. FY2021.3 |

ー |

△14.7% |

100.0% |